Law Offices Ronald S. Siegel Professional Corporation

Established in 1986

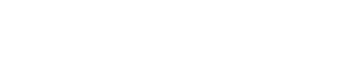

Providing Bankruptcy and Financial Protection for Residents of Metro Detroit & Southeast Michigan.

Eliminate debt and get a fresh start - Call today for a free initial consultation

If you are facing mounting debt, wage garnishment, foreclosure or bank levy, Ronald Siegel, PC is here to help give you a fresh and debt-free new start. Together, we will analyze your financial situation to determine if Chapter 7 or Chapter 13 or perhaps even an alternative to bankruptcy best meets your needs, and we will use any and all methods available under the law to protect you from creditor lawsuits, collections, foreclosure, threats and harassment.

We Can Help You With:

Serving Metro Detroit And Southeast Michigan

What our clients say about us

Dedicated And Experienced Bankruptcy Lawyer At Your Service

With more than 35 years of legal experience and knowledge in helping clients achieve a debt free fresh start, Ronald Siegel, PC believes in treating clients with care, respect and dignity. You will get the benefit of:

- Extensive knowledge of the bankruptcy laws for both Chapter 7 and Chapter 13

- Prompt and direct personal contact with and access to Ronald Siegel at all stages

- A complete understanding of the applicability of the law to your unique financial situation

- Reasonable Fees

Attempting To Tackle Unscrupulous Creditors On Your Own Can Be Frightening And Dangerous. The Peace Of Mind That An Expert Is Working To Protect You And Your Family Is A Phone Call Away.